- Defra’s first official UK Supply and Demand estimates for this season, released earlier today, suggest tighter domestic wheat supplies for the second consecutive season. The balance between availability of wheat and domestic consumption is forecast at 2.648 million mt in 2017/18, 18% lower year on year. This is 118,000 mt lower than the wheat balance forecast in the AHDB Early Balance Sheet in October and reflects the very latest information available. Total availability of wheat, at 18.530 million mt, is slightly higher (50,000 mt) than the amount forecast by AHDB in October, due to an upward revision in imports. However, this is offset by higher forecast domestic demand. Wheat consumption in animal feed is estimated at 7.396 million mt, 217,000 mt higher than the AHDB forecast last month.

- GB animal feed statistics for September 2017, released by Defra earlier this month, showed higher usage of wheat in compound feed year on year, as well as compared to July and August this season. Furthermore, poultry data published last week revealed record number of UK broiler and layer chick placings in October, which bodes well for wheat demand in feed. As a result, Defra forecast wheat demand in animal feed to increase by 1% (88,000 mt) this year compared with 2016/17. After taking into account the operating stocks requirement of 1.6 million mt, the estimated surplus of wheat available for export or free stock in 2017/18 is 1.048 million mt, down 35% year on year. Looking back, the current forecast is the lowest since 2013/14.

- There is a contrasting situation for domestic barley supplies, compared with wheat. Defra forecast the 2017/18 surplus of barley available for free stock or export at 1.713 million mt, 21% higher year on year. This is slightly lower (68Kt) than AHDB’s forecast in October.

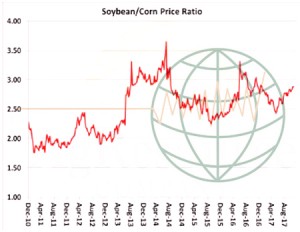

- Fund managers have been right to bet on long soybeans vs. corn (or wheat). The soybean/corn chart below reflects that soybeans have outperformed corn since late summer. Record large world soybean demand along with aggressive Argentine corn sales has helped the soy/corn ratio. In addition, if there is a La Niña weather problem in S American this winter, soy will continue to gain on corn with the ratio potentially reaching above 3:1. Plainly stated, US corn lacks a demand story in coming months. It is all about S America going forward.

- January soybeans traded in just a 7.25 cent range for the day, and finished down half a cent. While soybeans were quiet, more active trade was noted in soy product markets and spreads. January soyoil had support above the 200 day moving average, but could not get above the 50 day moving average. Funds were estimated sellers of 500 soybean and 1,000 soyoil contracts, while buying 3,500 contracts of meal. While US soybean exports have slowed dramatically in the last several weeks, and are starting to cast doubt on the potential for annual exports, China continues to process beans at a record pace. Last week’s soybean crush was estimated at just under 2 million mt, which was the largest weekly figure of the year. The cumulative crush rate is now estimated at 16 million mt, and the current pace is right on track to reach the USDA’s annual forecast of 94 million. US exports have been slowed by late season S American exports. Brazil has exported nearly 2 million mt in November with 1.4 million scheduled for December. World soy demand is record large; January soybeans have held in a broad range since September, which looks to continue into late in the year. S American weather and crop size will determine prices into year end. Our view is that there will more than likely be a number of strong weather rallies.

- Corn futures rebounded ahead of first notice day on Thursday. Fundamentally, what news is available is modestly supportive. Argentine cash basis levels continue to rally, the pace of US ethanol production is record large, and there is evidence that this winter’s La Niña could be stronger than initially forecast (much more attention will be paid to Argentina rainfall during December). Also, funds still hold a record net short corn position. US ethanol production through the week ending Nov 24 totalled 313 million gallons, down just slightly from record production in the previous week. Cumulative US ethanol production is 4% above last year, vs. the USDA’s projected 1% increase. US ethanol export interest continues as world energy markets remain firm. Parts of Argentina will benefit from good rainfall in the next 24 hours, but many key parts of the Corn Belt will miss out. We have previously highlighted that even sub-trend yield there won’t materially affect its exportable surplus, but no doubt weather premium will be added if dryness persists during December.

- US and European wheat futures ended higher, and in the US pre-first notice day liquidation has ended. Black Sea cash prices are unchanged, but European values are higher, and still there is talk that Northern Europe’s hi-pro exportable surplus is dwindling fast. On paper, Gulf HRW is more competitive than it was just weeks ago. There is just not a lot of input available to trigger any meaningful selling below $4.10, basis spot Chicago futures. Otherwise, it was a pretty slow news day but more attention will be paid to Plains dryness in the months ahead. The EU and GFS weather models have eliminated the chance of rainfall across the Plains next week. The equatorial Pacific has also cooled dramatically, and some models predict a rather strong La Niña through Jan/Feb, which historically correlates with warmth and dryness across the Southern HRW Belt. Plains soil moisture surpluses are eroding. Like corn, farmers will not be willing sellers at current prices, and a 15-20 cent rally is anticipated.