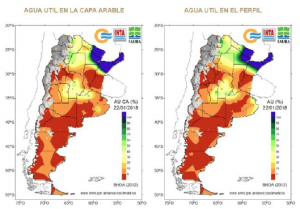

- Chicago is mixed at noon with soybean/soymeal under pressure with the grains firmer. The meal market is sliding after a nearly nonstop rally over the past nine trading sessions. It appears that funds managers want to bank some profits before the weekend following their recent heady gains. Soybeans have followed the meal market, which has been the case all week long. March soymeal has encountered resistance near $350.00/ton once again. Spot soymeal did score a new rally high at $348.50/ton, but to reach above this level requires the confirmation of an Argentine soybean crop below 50 million mt. Argentine soymeal exports would be constrained on a production level below 50 million, which is a level that world crushers have been monitoring. Corn and wheat prices have been largely supported by rising crude oil prices, improved Brazilian ethanol demand, and the falling US$. Grain/soy spreading has also offered a bullish tailwind. We doubt that a new bearish price trend can emerge in the grains with the specs acting as buyers of breaks.

- CBOT floor brokers estimate that funds are net sellers of 4,200 contracts of soybeans and buyers of 4,100 contracts of corn and 2,900 contracts of wheat. In soy products, funds have bought 2,600 contracts of soyoil while selling 4,600 contracts of soymeal.

- US Gulf corn is priced at $163.50 this morning against $167/mt out of Argentina and $173/mt from the Ukraine. It is very difficult to find a Brazilian corn offer from February through May. We don’t expect that Brazil will return as a large corn exporter until July. US Gulf corn is cheaper than Argentine offers through June as a result of their declining corn crop prospect. IMEA estimated Mato Grosso soybean harvest progress at 12.3% vs 16.2% last week. The warm and dry weather pattern allowed for farmers to push ahead with harvest. The current pace is right at the 5 year average.

- Every market needs a rest and such is the case for soybeans/meal this morning. However, we see nothing that would alter the prevailing Chicago uptrend with S American weather too dry for Argentina and too wet for N Brazil amid a falling US$. The weekly CoT report needs to show a big decline in fund net shorts or additional covering will be witnessed next week. Higher prices likely lie ahead.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 26 January 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data