- Awaiting tomorrow’s report has been today’s feature. Soybean yield will be the main point to watch for; sub 52 bushels/acre will be seen as supportive whilst 52.5 plus will be bearish. The “dragalong” impact on the grains should not be underestimated. Other fresh input is lacking and if there was any it would probably be ignored ahead of the USDA release.

Author Archives: simon

10 October 2016

- The day has had potential to be a touch quieter than usual with US banks closed in observance of the Columbus Day holiday, a national holiday in Argentina and Canada is celebrating their Thanksgiving holiday. With the USDA report scheduled for Wednesday it is likely that trading will be subdued until it is released.

- We have seen corn and wheat prices a touch higher with the explanation pointing at a lack of farmer selling in corn, which is elevating cash prices. The farmer appears more keen to sell soybeans and put corn into storage, where it will likely stay until cash is required to finance spring seed and fertiliser. The corn harvest is likely to have reached as much as 44% whilst soybeans are probably above 50% as the weekend saw dry and sunny weather conducive to harvest. The Plains winter wheat planting is also proceeding well with estimates as high as 65% complete.

- Today has been a macro day in Chicago with crude oil pushing to new rally highs and a host of asset markets rising as US interest rate futures are weaker. It should be noted that crude oil chart patterns have formed an inverse head and shoulders pattern, which is potentially bullish, and indicative of a brightening global outlook. Fund managers are looking for value and picking assets that look cheap, and Chicago grain markets could well be viewed as such.

- It appears that India may have secured 500,000-600,000 mt of Black Sea wheat and could now well be looking at cheaper Australian supplies in the immediate short term.

- Wednesday and the USDA report will likely determine price direction for the remainder of the month. A 2016 soybean yield of less that 52 bushels/acre will likely trigger a sharp price rally, although it is strongly rumoured that a figure of 53 bushels/acre could well be published. Corn yield is much less hotly debated with 173-174 bushels/acre widely anticipated. We continue to contend that the grains are hitting, if not have hit, their seasonal lows if the soybean market does not score new lows. However, any strong rally in grains (maybe 20 cents) would have us looking to sell once again. Rangebound trade is still out view.

7 October 2016

To download our weekly update as a PDF file please click on the link below:

Weekend summary 7 October 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

5 October 2016

- Egypt’s GASC has made another wheat purchase in its latest tender, for early November shipment. Russia was the sole successful render winner, achieving 240,000 mt at a price reported at $187.20/mt basis C&F, which is a mere 17 cents above the last tender on 22 September.

- Informa Economics late yesterday pegged US corn yield at 174.5 bushels/acre with production at 15,215 million bu, which compares with the latest NASS estimate of 15,093. Soybean yield was estimated at 51.6 bushels/acre with production at 4,300 million bu with the NASS number standing at 4,201 million bu. The numbers put out by Informa are regarded as slightly bearish, if realised, because the additional production will likely drop straight into end stocks rather than find their way into either exports or consumption.

- Today has seen Chicago wheat jump whilst corn is about unchanged and soybeans are trading lower as we head into the close. Morocco is reported to have made another sizeable purchase of US wheat, which has added support and short covering has followed. 260,000 mt was reported to have been sold; the recent pick up in Russian FOB levels has left US Gulf highly competitive and doubtless security of quality will also be relevant in this variable quality year.

- Combine reports from the northern half of the corn belt have improved according to information we are picking up. Record yields reports in IL are becoming more frequent and N Plains data is very good when compared with last year. Soybean yield trend continues unchanged with mostly record yields being reported, the “big crop” story machine continues to roll!

- The fund’s net short position in Chicago is looking more vulnerable as the US finds export demand and global quality issues remain. Our view that downside risk in wheat is limited is strengthening and this will potentially provide support to corn in the longer term. However, the big picture remains one of “big crop” and “big demand” and it remains a tough call to support either the bulls or the bears in a major way.

4 October 2016

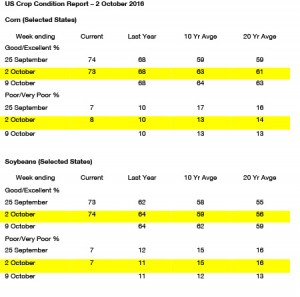

- Chicago soybeans were lower at midday following a surprise boost in crop rating, grains were close to unchanged. Rarely, if ever, do crop ratings improve into harvest, more usually we see a decline in rating, this alongside the continuing “stellar” yield reports is placing the “big crop” supply argument stand head and shoulders above the “big demand story”. FC Stone put soybean yield at 52.5 bushels/acre, which if realised would add another 100 million bu to US end stock all other elements remaining unchanged. Corn held up well despite FC Stone’s yield update at 175.2 bushels/acre although we would point out that they are more often than not above NASS’s October published figure.

- Egypt has managed to elicit nine offers in its latest wheat tender, a big improvement on previous forays into the market, maybe showing that trust is creeping back into their supply chain. We have not received any purchase confirmation, and the cheapest offer was Russian at $177/mt some $7/mt above morning quotes!

- Funds near record net short position in corn established in early September largely accounted for this year’s build in stocks. Now it’s all about fine-tuning crop size and measuring export potential. We look for steady/higher grain prices into late year, though we’d be careful in holding long position amid so far favourable weather in S America. The issue in soybeans is whether NASS prints a 52 plus bu yield next Wednesday?

3 October 2016

- Today saw something of a turnaround as corn and soybeans shrugged off early losses to trade7-15 cents higher at midday. Wheat continued to languish 5-8 cents lower in the face of coming rains in E Europe, Ukraine and Russia and welcome drier weather in E Australia through to mid-October.

- The morning rally appears chart based with December ’16 corn futures finally breaching, and sustaining, $3.40 resistance, which now becomes support. The market was unable to push November ’16 soybeans to new lows and short covering followed.

- Additional upside momentum is possible if today’s rally holds and a fundamental based trend is likely in the run up to the October USDA report, trading through the rest of the week is likely to be somewhat more mixed .

30 September 2016

To download our weekly update as a PDF file please click on the link below:

Weekend summary 30 September 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

29 September 2016

- US export data has been released as follows:

- Brussels has issued weekly wheat export certificates totalling 568,875 mt, which brings the season total to 7.0 million mt. This is 1.3 million mt (23.1%) ahead of last year. Barley exports for the week reached 8,853 mt, which brings the season total to 1.19 million mt, which is 2.25 million mt (65.5)% behind last year.

- Today appears to have been all about pre-report positioning with corn, soybeans and wheat all pulling back from early highs as many fear a bearish corn and wheat stock estimate from NASS tomorrow.US soybean stocks are expected to be somewhat more neutral to bullish but strong yield talk persists. Some of the early trade was linked to the OPEC announcements and surging energy markets.

- Russia is reported to have harvested close to 115 million mt (clean weight) of grains of which wheat accounts for 72.5 million, which could leave them in a position to export as much as 30 million mt, an increase of 5 million over last season. The potential quality downgrade due to sprouted grains could well mean that there is a greater emphasis than normal on feed wheat exports.

- ABIOVE have estimated the 2017 Brazilian soybean crop at 101.3 million mt, which is in line with the general range of expectations that stand at 99-102 million mt. The midday S American weather forecast is calling for showers to increase across N Brazil, which would likely increase soybean seeding rates. The initial weather forecasts for S America look favourable for spring seeding and heading of winter grains.

- The USDA Stocks and FinalGrain report tomorrow together with concern over some European banks (and their bad debt) have caught the attention on Chicago traders. US equity markets turned lower although the US$ is little changed. Despite this, we do not see the current trading range breaking until after the October WASDE report, scheduled for release on 12 October.

28 September 2016

- Chicago markets have been somewhat lacklustre today and the week’s price break has doubtless uncovered export demand within the US and we continue to question by how much these markets can rally during the peak US harvest period. There appears to be little sign of the trend in soybean yield changing, and C Plains results continue to be reported as excellent.

- Chinese soybean demand remains solid with some 344,000 mt sold (as per US daily reporting system) and it has been reported separately that upwards of 30 cargoes have been secured by China from the US and S America through to springtime. The supply driven price weakness is uncovering demand below market – unsurprisingly!

- The US reporting system also showed 1.6 million mt of corn sold to Mexico of which a million is for 2016/17, the fourth largest single sale on record.

- Weather forecasts remain generally favourable for continuation of the uninterrupted harvest through to late next week, which is good news for the growers and overall crop output.

- Our summary remains little changed with big corn and soybean supplies in the pipeline, which are capping rallies. End users have (and will likely continue to) extend coverage on breaks, and this pattern looks likely to continue until mid-October with neither the bulls or the bears able to take the upper hand – unless some fresh fundamental input emerges.

27 September 2016

- Tuesday saw soybeans under pressure from follow through liquidation but found support at the new monthly low finishing higher on the day as late short covering featured.

- Corn saw the anticipated Turnaround Tuesday as it rebounded higher, but tha fact that US Gulf corn is the world’s cheapest is probably more significant. Gulf corn is marginally above Black Sea feed wheat for spot delivery. Despite the rally, funds continue with a sizeable net short, estimated at 180,000 contracts compared with 166,000 last Tuesday. Ethanol futures settled higher for the fifth consecutive day and production margins have grown to more than $1/gallon (basis spot futures). Such profitability has not been seen since around 2014 and this will likely drive production still further. Clearly the big supply/big demand picture remains intact, and neither a bullish or bearish stance has much to commend it at present!

- There are a number of global wheat tenders due to close this week, including a Moroccan US only tender and this has lent support to the market. The last Moroccan tender saw 265,000 mt of US wheat sourced and a similar volume is expected in this latest round highlighting the US’s competitive position. US Gulf prices compare well vs. Black Sea into late autumn. EU cash prices continue to inch higher with both German and French offered at $188-189/mt for spot delivery whilst US Gulf is $187 for SRW. We would expect to see global milling demand move towards the US as a reliable source of supply in coming months. There are quality concerns in Australia and Canada and there is even talk that Russia is blending its higher quality old crop supplies with new crop to meet standards. This is not a time to be bearish wheat!