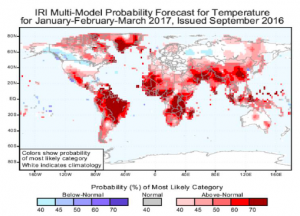

- Monday morning in Chicago saw prices in the red as weather models confirmed a further six to eight days of dry and mild weather. Soybean yield reports continue to stay mostly above or at expectations and C Illinois corn yields showed signs of improvement in the last half of last week. It seems that we will see further pressure as harvest ramps up and expands and we may well be witnessing the funds unwinding their net long position in soybeans, albeit slowly and maybe even reluctantly.

- Soybean meal has made new lows for this move and more DDG’s will doubtless compete for feed demand in coming months adding more pressure. EU prices in wheat and rapeseed dipped in sympathy with their bigger cousins in Chicago.

- We saw no further US soybean sales announcements today although the break will likely see a resumption of pricing and purchases as the week progresses. Chinese crush margins are reported to be at record highs for a spot position and they will doubtless want to lock in as far forward as possible if history is anything to go by. A “Turnaround Tuesday” is possible tomorrow, but still there is just too little available for the bulls to push values higher, with a vast majority of the Midwest harvest due in the first two weeks of October. Interior cash basis levels have been in retreat since early last week, as producer become more comfortable with yield estimates. Recent rallies in corn and soybeans have prodded supplies from farmers and end user/exporters remain unwilling to chase rallies higher.

- The only meaningful weather threat remains in Australia, where additional soaking rainfall is projected across Victoria and New South Wales through this weekend. The trade there is now more closely watching for quality issues. Early week trading recently has been mostly about yield estimates and combine reports. Understandably, it is difficult to find support amid ongoing record soybean yield data. Substantial demand lies below the market, and we maintain that range-bound trade will likely persist.