Our USDA report contemplation can be downloaded by clicking on the link below:

Author Archives: simon

9 September 2016

To download our weekly update as a PDF file please click on the link below:

Weekend summary 9 September 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

8 September 2016

- Brussels has issued weekly wheat export certificates totalling 540,869 mt, which brings the season total to 5.494 million mt. This is 1.454 million mt (36%) ahead of last year. Barley exports for the week reached 39,079 mt, which brings the season total to 1.021 million mt, which is 1.712 million mt (62.65)% behind last year.

- US export data will be published tomorrow, a day later than usual due to the holiday closure on Monday.

- Chicago is once again a mixed picture with the grains, corn and wheat higher and soybeans trading just in negative territory. There is little market moving fresh news again, and the market is awaiting the USDA report data. Average trade guesses feature a lower corn yield next week (173.4 vs. USDA’s 175.1), and a slightly higher bean yield (49.2 vs. USDA’s 48.9), and early harvest results display the same trend so far. Soybean yield potential is very good; corn yields have been lower than expected although it’s far too early to determine a nationwide trend.

- Egypt’s ergot saga continues. Today, Romanian exporters say a cargo of wheat wasn’t rejected this week but rather the exporter declined to ship based on Egypt’s change in quality specifications. Similar battles over Egyptian wheat shipments will continue until the policy is changed, and note that another cargo of Russian origin has been moored off Egypt since July.

- Clearly all eyes are on the upcoming report and pre-report positioning is evident. The supply debate will focus upon a corn yield of 170-175 bu/acre and soybean yields of 48-51 bu/acre. Barring any major surprises or upsets it seems that fair value for soybeans is in the $9.50-$10.50.bu range whilst corn at $3.20 to $3.60 into late year. Doubtless export sales will become as important supply in coming days and weeks.

6 September 2016

- We have seen a mixed start to the week in Chicago (closed yesterday for Labor Day holiday) with the soybean complex higher and grains a touch weaker at midday (which remains the position into the close). It was soybeans that first caught a bid on news of better than expected export shipments and forecast soaking rain across much of the Midwest this week. It is the grains that are lacking excitement – for now! Next Monday sees the next USDA report and it could be that if record corn yield is confirmed we could well see the season low formed and trade move on from there; we will have to wait until Monday for that one!

- The US soybean export numbers (see above) were once again impressive with 45.3 million bu of beans shipped (to week ending 1 September) vs. A mere 3.0 million bu last year. 38 million were scheduled for shipment in the 2015/16 crop year, which should see final US exports at, or close to 1,940 million bu. This is some 60 million above the USDA’s August figure, and if reflected next week, should see end stocks decline by a similar amount to 195 million bu. This, in turn, will place pressure on new crop yield unless we are to see new crop end stocks below 300 million bu.

- In corn the position is similar, but to a much lesser degree with final exports potentially 15 million bu above the USDA’s August level. This is less of an issue than is the case with soybeans but could also see season lows confirmed.

- CONAB further lowered its estimate of total Brazilian 2015/16 corn production to 67 million mt vs. the USDA’s 68.5, and so Brazilian corn production continues to inch closer to domestic consumption forecasts. We note that Brazil’s ship lineup is in retreat, a majority of Brazilian corn export sales should be finished by late September or early October, and we maintain that Brazil’s exportable surplus will be closer to 16 million mt than the USDA’s 17.5 million. CONAB’s soybean production forecast was left unchanged at 95.4 million mt vs. the USDA’s 96.5 million. Brazilian soybean exports are now struggling amid a lack of offers.

- The US$ was sharply lower, reported to be on account of disappointing non-manufacturing economic growth figures in August leaving the US$ below last week’s low, which adds to upside price pressure.

- Overall, the bears continue to cite record yields and rising private soybean production estimates whilst the bulls cite the US’s newfound status in world markets (much more competitive) as well as record export potential. The outcome will doubtless be clear in the next three to four months but, for now, it is too tight to call either way although we would not wish to be short at current price levels.

2 September 2016

To download our weekly update as a PDF file please click on the link below:

Weekend summary 2 September 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

1 September 2016

- The USDA has today released its weekly export figures as detailed below:

Wheat: 594,100 mt, which is within estimates of 300,000-600,000 mt.

Corn: 1,464,500 mt, which is above estimates of 600,000-1,250,000 mt.

Soybeans: 1,119,600 mt, which is within estimates of 950,000-1,800,000 mt.

Soybean Meal: 177,600 mt, which is within estimates of 75,000-325,000 mt.

Soybean Oil: 12,500 mt, which is within estimates of zero-50,000 mt.

- Brussels has issued weekly wheat export certificates totalling 581,266 mt, which brings the season total to 4.95 million mt. This is 1.28 million mt (34.9%) ahead of last year. Barley exports for the week reached 7,135 mt, which brings the season total to 982,118 mt, which is 1.62 million mt (62.3)% behind last year.

- Chicago markets have had little in the way of selling pressure today and fund short covering has produced something of a solid bounce, the first upward move of note in some time. End user covering was also noted at low prices but this appears to have eased as prices moved north. It is interesting that price support in corn futures now lies solidly at the $3.00/bu level, set at the time of the US meltdown in 2008 and early 2009!

- Seasonal price trends would have us looking for prices to rally, from harvest lows, into October as the N Hemisphere harvest draws to a close. Consequently we remain of the view that downside risk in the grains is low, and in soybeans the likelihood of a tradable bottom forming is growing. Our view is compounded by the size of the funds short positions, which (as we report on a regular basis) provides a potential springboard for prices to spike from.

- We await crop estimates from FC Stone and Informa Economics tomorrow and the market could well pick up on any overtly bearish (or bullish) input from these data releases.

31 August 2016

- Chicago markets are somewhat more mixed today with the grains, corn and wheat trading with modest gains whilst soybeans are again lower on further fund selling. It is first notice day and positions are being pared back as debate rages hotly on just how high the US national soybean yield will be in the September report. Nov ’16 soybeans have dropped below the early August low of $9.43, and closing levels will bear close scrutiny for clues to further direction. News that Chinese delegates to the US are in the process of agreeing frame contracts is not hugely significant as they take place pretty much every year although it is a market talking point.

- Soybeans falling to two week lows, the ongoing big supply story amid general commodity weakness and US$ strength continue to lead the market. Improving crop condition in late August is rare and this is also foremost in price discussions at present, as is the lack of threatening weather into mid-September, which will likely benefit the crop further. Studies are starting to suggest that downside objectives are close at hand, hence our reluctance to join the bearish trend. We should remember that soybeans are a global crop and whilst US yield/output is close to being a “done deal”, we will not know the relevance of S American crop weather until year end. To that end US supply and demand is one factor and S America is another, we should not lose sight of that.

- Egypt cancelled its latest wheat tender having received a solitary Ukrainian offer, recall our suggestion that exporters may well be reluctant to engage in fresh activity in the light of the renewed zero tolerance ergot policy.

- Russia’s AgMinistry has proposed eliminating ite wheat export tariff effective 15 September. Whilst not a significant factor the key going forward will be export capacity and whether the prior record 25.5 million mt figure can be exceeded; winter conditions will be a major factor.

- Big or record US crops continue to be digested, while there is a first indication of demand rising at current cheap prices. A bullish outlook is not advised at this time. Whether NASS yields match expectations will be theme of mid-September.

30 August 2016

- The graphic below highlights the “silver lining” of falling grain prices! US ethanol margins have been rallying steadily since late summer, and there is even a modest incentive given to ethanol blenders, basis spot prices. Also, in the cash market, calculated margins are some $.10/gal above ALL costs, and so the market is working to clear excess supplies. US corn end stocks look likely to stay north of 2.0 billion bu, and no doubt a record crop will harvested this autumn. It is just that with prices at multi-year lows, and the goal of the market to find/boost consumption this is being accomplished slowly but steadily. Supply data will have been fully digested by early September, and focus thereafter will be placed upon US demand and S American seeding intentions.

- We should note that Egypt made their third wheat tender of the season last Friday and secured 180,000 mt from Russia for late Sep/earlyOct shipment at a reported price of $185.52/mt basis C&F, which is more than $8.00/mt above the 12 August tender. The market on Monday was sharply lower on further news from Egypt, this time they have reverted to a zero tolerance policy on ergot contamination. International acceptance standards permit 0.5% contamination but Egypt has once again adopted their last season (partial) zero tolerance. This will push their costs higher as exporters only commit with reluctance as the costs of rejection are so high, in addition the absence of France (so far) from international line-ups will further restrict Egyptian options.

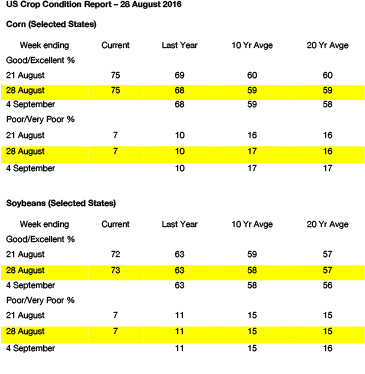

- Monday saw another week of what could best be described as excellent US crop condition ratings, which spurred weakness, and this has been followed today. We remain in the grip of the supply side of the equation and many are speculating on a boost in soybean yield in the September USDA crop report. The ProFarmer tour results, released late on Friday, placed yield at 49.3 bushels/acre, higher than the USDA’s August estimate, and the weather appears to remain favourable potentially seeing further yield upside prior to harvest. It is interesting to note that on an historic basis the ProFarmer estimates have tended towards under rather than over estimation.

- The tour corn yield estimate was reported at 170.2 bushels/acre, below the USDA by 4.9 bushels/acre, which if proven correct would see end stocks a touch below 2 billion bu. However, the market was not shaken and Monday saw the fifth consecutive lower close and Friday saw new contract lows.

- The US markets are suffering some pain right now as they dip yet lower searching for price levels that will trigger a demand led recovery. August is traditionally a weak period for soybean and grain markets, it seems that the US is moving back towards becoming a dominant exporter by mid-autumn.

25 August 2016

- The USDA has today released its weekly export figures as detailed below:

Wheat: 379,700 mt, which is below estimates of 400,000-600,000 mt.

Corn: 1,131,000 mt, which is within estimates of 900,000-1,250,000 mt.

Soybeans: 2,054,700 mt, which is above estimates of 1,150,000-1,500,000 mt.

Soybean Meal: 213,800 mt, which is within estimates of 90,000-300,000 mt.

Soybean Oil: 3,700 mt, which is within estimates of zero-40,000 mt.

- Brussels has issued weekly wheat export certificates totalling 491,748 mt, which brings the season total to 4.372 million mt. This is 972,690 mt (28.6%) ahead of last year. Barley exports for the week reached 79,945 mt, which brings the season total to 974,983 mt, which is 1.4 million mt (59.0)% behind last year.

- Latest global crop estimate figures released today include SovEcon’s 2016 Russian grain output at 117 million mt, a month on month increase of 1.7 million. This includes 73 million mt of wheat, which accounted for the overall increase.

- The International Grains Council increased their 2016/17 global wheat output estimate to 743 million mt, a 8 million mt increase from last month. 2016/17 global corn was put at 1,030 million mt, 13 million above July and up from 969 million mt last year. Global soybean output for 2016/17 was also estimated higher than last year at 325 million mt, which is a 9 million mt increase. Of note was that US corn output was increased 14 million mt month on month to 379 million mt.

- News was received today that the Nord Cereals silo facility in Dunkirk, which is a delivery point for MATIF wheat, is to suspend deliveries as of Monday. No further information was given.

- Chicago markets have seen a “red” session so far today with soybeans pacing the way lower with the grains similarly easing. It seems that China has a limited desire to extend cover much further forward and the story swings from “big demand” back to “big supply” as we have suggested would be the case on m ore than one occasion in recent weeks.

- The ProFarmer tour results continue to give potential for a modest hike in the next NASS yield report due for release in September whilst they currently validate a corn yield at/close to/just above 170 bushels/acre. Consequently we are unlikely to see any substantial downward adjustment in US corn supplies. US crop supplies remain in an upward trajectory and end users can see this, and are less inclined to follow or chase rallies right now. The final ProFarmer results will be available on Friday and we will update as and when we have the data.

- It must not be forgotten that we are still in the month of August and right now it is supply ideas that are driving markets and prices, and likely to remain the case until early US harvest is well under way. With funds heavily short and US corn now globally competitive we see the global market building (albeit slowly) a sizeable demand base, which is likely to see downside potential limited.

24 August 2016

- Chicago markets have seen further selling in the soybean complex as the Pro Farmer tour reports strong pod counts with obvious associations to yield prospects. November ’16 soybean futures pushed to a new weekly low, which in the event of a breach of $9.96 would see the trend reverse to downwards. Corn has made a rally attempt on the Pro Farmer tour suggestion that the NASS yield estimate is too high with its 175.1 bushels/acre forecast. Wheat is a follower (nothing changes!) and Chicago Dec ’16 futures pushed to new contract lows adding to the bearish profile.

- Recall our comments on big crop/big demand, we continue to caution against an overly bearish stance despite seemingly bearish fundamentals! Trade looks likely to remain rangebound until US harvest gets well into harvest or a S American weather problem emerges.

- The trade is watching the steady stream of internet updates from the Pro Farmer crop tour via social media. Traders are leaning to smaller US corn yield than USDA and larger soybean yield. Yet, export demand for Gulf corn, soybeans and wheat is cooling. Funds are exiting shorts in corn, but are flat in wheat and sellers of soybeans. It appears that the market has any real trend heading into this week’s close.