- The USDA has today released its weekly export figures as detailed below:

Wheat: 370,500 mt, which is within estimates of 350,000-650,000 mt.

Corn: 1,227,400 mt, which is above estimates of 800,000-1,200,000 mt.

Soybeans: 1,670,400 mt, which is above estimates of 1,100,000-1,700,000 mt.

Soybean Meal: 215,800 mt, which is within estimates of 65,000-300,000 mt.

Soybean Oil: 36,600 mt, which is above estimates of 4,000-30,000 mt.

- Brussels has issued weekly wheat export certificates totalling 420,389 mt, which brings the season total to 2.797 million mt. This is 699,616 mt (33.3%) ahead of last year. Barley exports for the week reached 92,113 mt, which brings the season total to 831,339 which is 53.81% behind last season.

- It has been a mixed, and frankly speaking, boring session so far in Chicago. Good, solid old and new crop soybean export sales have allowed some small gains whilst the grains have languished just below unchanged in the absence of fresh news. Nearby MATIF wheat prices are €uro 2/mt lower on news of recent imports into France from Romania, which are suggested (not confirmed) to be for delivery against MATIF futures.

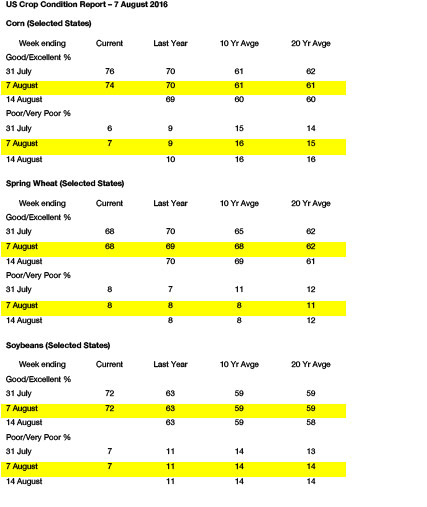

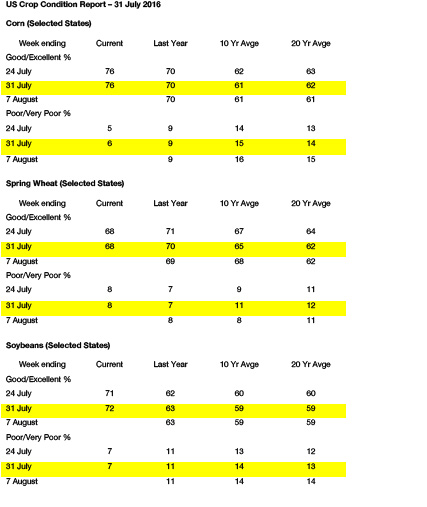

- We reiterate our view that the market needs to better understand and have confidence in the size of US wheat, corn and soybean crop output prior to turning attention to demand issues. We continue to anticipate a seasonal low price in the next few weeks.