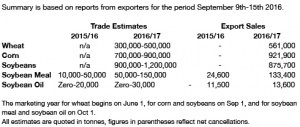

- US export data has been released as follows:

- Brussels has issued weekly wheat export certificates totalling 568,875 mt, which brings the season total to 7.0 million mt. This is 1.3 million mt (23.1%) ahead of last year. Barley exports for the week reached 8,853 mt, which brings the season total to 1.19 million mt, which is 2.25 million mt (65.5)% behind last year.

- Today appears to have been all about pre-report positioning with corn, soybeans and wheat all pulling back from early highs as many fear a bearish corn and wheat stock estimate from NASS tomorrow.US soybean stocks are expected to be somewhat more neutral to bullish but strong yield talk persists. Some of the early trade was linked to the OPEC announcements and surging energy markets.

- Russia is reported to have harvested close to 115 million mt (clean weight) of grains of which wheat accounts for 72.5 million, which could leave them in a position to export as much as 30 million mt, an increase of 5 million over last season. The potential quality downgrade due to sprouted grains could well mean that there is a greater emphasis than normal on feed wheat exports.

- ABIOVE have estimated the 2017 Brazilian soybean crop at 101.3 million mt, which is in line with the general range of expectations that stand at 99-102 million mt. The midday S American weather forecast is calling for showers to increase across N Brazil, which would likely increase soybean seeding rates. The initial weather forecasts for S America look favourable for spring seeding and heading of winter grains.

- The USDA Stocks and FinalGrain report tomorrow together with concern over some European banks (and their bad debt) have caught the attention on Chicago traders. US equity markets turned lower although the US$ is little changed. Despite this, we do not see the current trading range breaking until after the October WASDE report, scheduled for release on 12 October.