- HEADLINES: Wheat, soy, canola extend rally; Midday GFS weather forecast much drier in Minnesota.

- Chicago futures are higher at midday, with wheat and soybeans extended overnight gains. Pictures of very low-quality wheat in Europe are circulating this morning, with Paris milling futures up 5.00-6.00 €uro per tonne ($0.16-0.19 per bushel), while updated early yields from Russia show little improvement. Spring wheat and has scored new rally highs as model guidance has extended warmth and complete dryness in southern Canada into July 26. Canadian weather thereafter will have little or no impact on yield stabilisation. Canadian canola production estimates have cantered on 16-17 million mt, vs. USDA’s 20.2. Canada must ration its available canola supplies moving forward.

- China this morning bought 134,000 tons of US SRW. Traders are debating whether this is due to quality loss in France or whether this reflects the beginning of state-sanctioned Chinese buying of US products. China’s total purchase of SRW is estimated at 400-600,000 mt. We note that US SRW is expensive in the world marketplace, which suggests that new Chinese demand for new crop US corn and soybeans lies close in the offing. US Gulf soybeans for Sep-Oct arrival are now offered $12-16 per ton below Brazilian origin.

- Massive logistical issues will continue to plague Argentina, with Paraguay declaring low river levels as a state of emergency. Resources will be allocated to dredging waterways, but real improvement in river levels there will not occur until seasonal rainfall arrives in early/mid-autumn. Little/no rainfall is offered to Brazil/Argentina throughout the next two weeks.

- A sizeable grain elevator in the Central Midwest, which provided ample liquidity to the US rail market, has been forced into default. Structured contracts that performed well in neutral/bear markets have blown up during this year’s rapid transition to multi-year high prices. This underscores that the US farmer will not make the same mistake as last year in selling too much grain until production is known in Sep/Oct. In fact, our bet is that the world farming community as a whole will sell only what is necessary in the months ahead.

- Improved Central US weather in July triggered massive fund liquidation. As of Monday, we estimate managed funds net corn long position at 196,000 contracts, vs. 219,000 last Tuesday and vs. April’s peak of 400,000. Funds’ net long in soybean is pegged at 96,000, vs. a recent peak of 175,000. We mention this as North American weather will be a more bullish feature over the next 10-14 days as expansive high pressure ridge meanders aloft the Plains and Midwest. The critical question for the market is whether this pattern lingers into mid-August. Updated EU weather model guidance keeps high pressure ridging intact into Aug 15.

- Most likely, a tropical storm event will be required to materially change the Central US upper air flow.

- The midday GFS weather forecast is drier than the morning run across Minnesota and the Central Midwest. The GFS forecast also advertises regionally soaking rainfall in Nebraska, SE South Dakota and Iowa July 28-29, but confidence so far out is lacking. Otherwise, excessive warmth returns to the Central and Northern Plains next Tues-Fri, with max highs reaching the low 100’s across Kansas, Nebraska and the Dakotas. A cooler but very dry pattern evolves across the Central and Eastern Midwest beyond the next 48 hours. Our weather concern stays high.

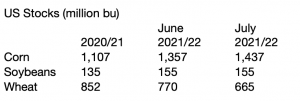

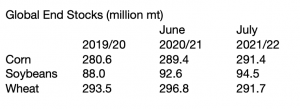

- US weather continues to dominate price determination, but there are signs that market focus is shifting to demand as evidenced by this week’s sizeable rally in soybeans. Wheat extends its bull run on Russian yield downgrades. Use nearby weakness in corn to add to supply coverage, as a boost in export demand is imminent amid Brazilian cash prices stay perched above $8.00 per bushel.

To download our weekly update as a PDF file please click on the link below: